Many couples facing divorce in Pennsylvania have questions about spousal support. The financial aspects of separation often create stress and uncertainty for both parties.

Pennsylvania law provides clear guidelines for spousal support agreements, which can be established either through court orders or mutual arrangements between former spouses.

These agreements help ensure financial stability for the dependent spouse while being fair to both parties involved.

This guide explains all the key elements of spousal support in Pennsylvania.

What is Spousal Support and Eligibility

Spousal support refers to regular payments made by one spouse to help maintain the other spouse’s standard of living after separation.

These payments serve as financial assistance during and after divorce proceedings in Pennsylvania. The spouse seeking support must meet specific requirements to qualify for payments.

Factors PA courts look at when deciding eligibility:

- The length of the marriage affects the likelihood of receiving support payments

- The receiving spouse must show a genuine need for financial help

- Both spouses’ current income and earning potential play a key role

- Health conditions or disabilities that limit workability strengthen the case

- The paying spouse must have enough income to provide support

The court reviews each case based on its unique circumstances. Some spouses receive temporary support during divorce proceedings. Others might qualify for longer-term support after the divorce becomes final.

How Spousal Support is Calculated

Pennsylvania courts use a specific method to determine support payments. The process starts with reviewing both parties’ monthly net incomes.

Net income includes salary, wages, bonuses, and other sources of money.

How Basic Calculation is Done

- The court subtracts the lower income from the higher income

- This difference is multiplied by a percentage set by state guidelines

- For couples without children, the rate is typically 40% of the difference

- When child support is involved, the rate changes to 30% of the difference

Factors that Affect Spousal Support

- Living Expenses: The court examines both parties’ basic needs. This includes housing costs, utilities, food, and transportation expenses. Medical insurance costs and regular healthcare need to receive special attention.

- Education and Training: Past contributions to education or training matter. The court looks at whether one spouse supported the other’s career growth. Future educational needs to gain employment skills also affect the amount.

- Standard of Living: The quality of life during marriage plays a role. The court aims to help the receiving spouse maintain a reasonable standard. This includes basic comforts established during the marriage.

- Age and Health: Physical condition affects earning ability. Older spouses might face more challenges finding employment. Health problems that limit work options can increase support amounts.

The court may adjust these amounts based on special circumstances. Each case is carefully reviewed to ensure the final amount suits both parties’ situations.

Regular income changes or job loss can lead to payment adjustments through the court system.

Rights and Responsibilities of Spousal Support

Both parties in a spousal support agreement have specific rights and responsibilities under Pennsylvania law. Understanding these helps ensure smooth payment arrangements and proper legal compliance.

Rights of the Receiving Spouse

- Receiving payments on time as ordered by the court

- Requesting payment records and documentation

- Asking for changes when circumstances shift

- Getting legal help if payments stop without reason

- Reporting payment issues to the court

Rights of the Paying Spouse

- Getting proof that payments were received

- Requesting changes if income decreases

- Stopping payments when legally permitted

- Claiming tax benefits as allowed by law

- Reviewing the receiving spouse’s changed financial status

Shared Responsibilities

- Keeping accurate payment records

- Updating contact and employment information

- Reporting significant income changes

- Following court orders exactly

- Attending required court hearings

- Providing honest financial information

The court expects both parties to act in good faith. Breaking these agreements can result in legal consequences.

Temporary vs. Permanent Spousal Support

Pennsylvania courts recognize two main types of spousal support arrangements. Each type serves different needs during and after divorce proceedings.

| Temporary Spousal Support | Permanent Spousal Support |

| Starts during the separation period | Begins after the divorce becomes final |

| Helps maintain basic living standards before divorce | The amount differs from temporary support |

| Lasts until the divorce becomes final | Usually has a set end date |

| Covers immediate financial needs | Stops if the receiving spouse remarries |

| This may change when the divorce settles | It can last several years based on marriage length |

| Helps with daily expenses and housing costs | It may end if the receiving spouse lives with a new partner |

The type of support granted depends on each case’s facts. Some cases only need temporary support. Others require both types to ensure fair treatment.

Duration of Spousal Support

The time for spousal support payments in Pennsylvania differs with each case. Courts check several time-based factors to set proper payment timeframes.

Marriage Length and Support Periods

For brief marriages under five years, support often runs for one to three years. Marriages lasting between five and ten years may lead to support for three to five years. Marriages over ten years might mean support lasting five to ten years. When marriages go beyond 20 years, courts might order support for much longer periods.

Ending Support

Support payments can stop in several ways:

- When the person getting payments remarries

- If either person passes away

- When the person getting payments can support themselves

- When the court-set end date comes

- If both people agree to stop payments

- When big money changes happen

Each case is reviewed closely to ensure fairness. The main aim is to help the person receiving payments achieve financial freedom when possible. Courts change support length based on proof of new needs or life changes.

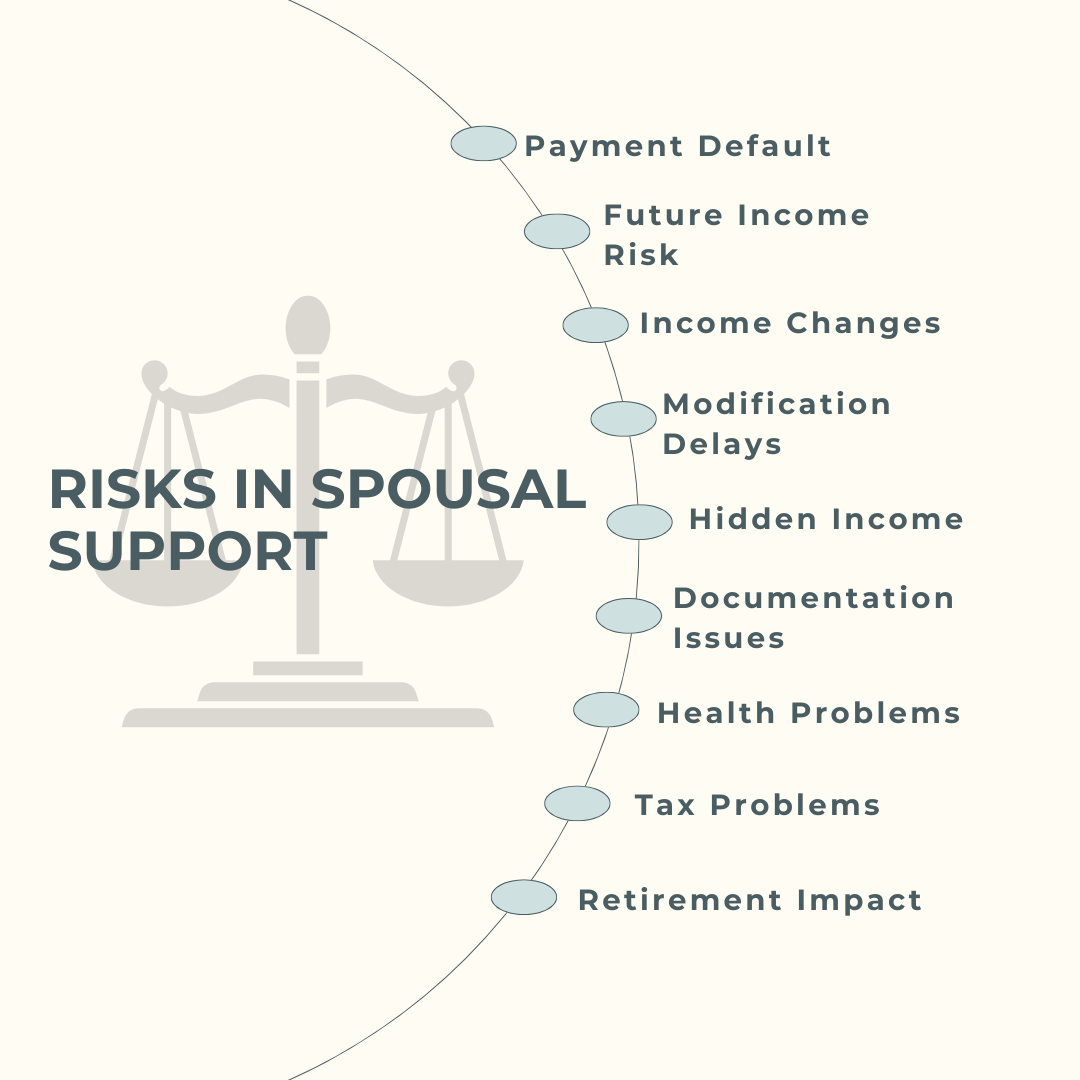

Risks in Spousal Support

Conclusion

Spousal support agreements in Pennsylvania aim to provide fair financial arrangements during challenging times. Understanding these agreements helps both parties make better choices during separation and divorce.

The courts work to balance the needs of both spouses while following state guidelines.

Remember that each support case differs based on unique situations. Getting expert legal help early can protect your rights and lead to better outcomes.

A skilled lawyer can guide you through payment calculations, time limits, and possible risks.

Frequently Asked Questions

How Many Years Do You Have to be Married in PA to Get Alimony?

Pennsylvania has no minimum marriage length requirement for alimony. Courts look at marriage length along with other factors to decide payment amounts and duration.

What is a Wife Entitled to in a Divorce in Pennsylvania?

In Pennsylvania, a wife can receive a fair share of marital property, spousal support, alimony, and child support if needed. Both spouses have equal rights to marital assets.

What is the Difference between Spousal Support and Alimony in PA?

Spousal support occurs during separation before divorce. Alimony starts after the divorce becomes final. Support helps with current needs, while alimony assists with long-term financial stability.