Are you looking to figure out alimony in Florida? The calculations might seem complex initially, but they don’t have to be.

An alimony calculator helps break down the numbers in a simple way. Want to know what factors shape alimony payments in Florida?

The calculator considers the length of the marriage, each person’s income, and their standard of living during the marriage. But there’s more to it than just entering numbers.

This guide explains how Florida alimony calculators work, what information goes into them, and what the results mean.

Let’s look at the key parts of calculating alimony so anyone divorcing can understand what to expect.

Understanding the Florida Alimony Calculator

Florida’s alimony calculators serve as useful tools that help estimate possible payment amounts during divorce proceedings.

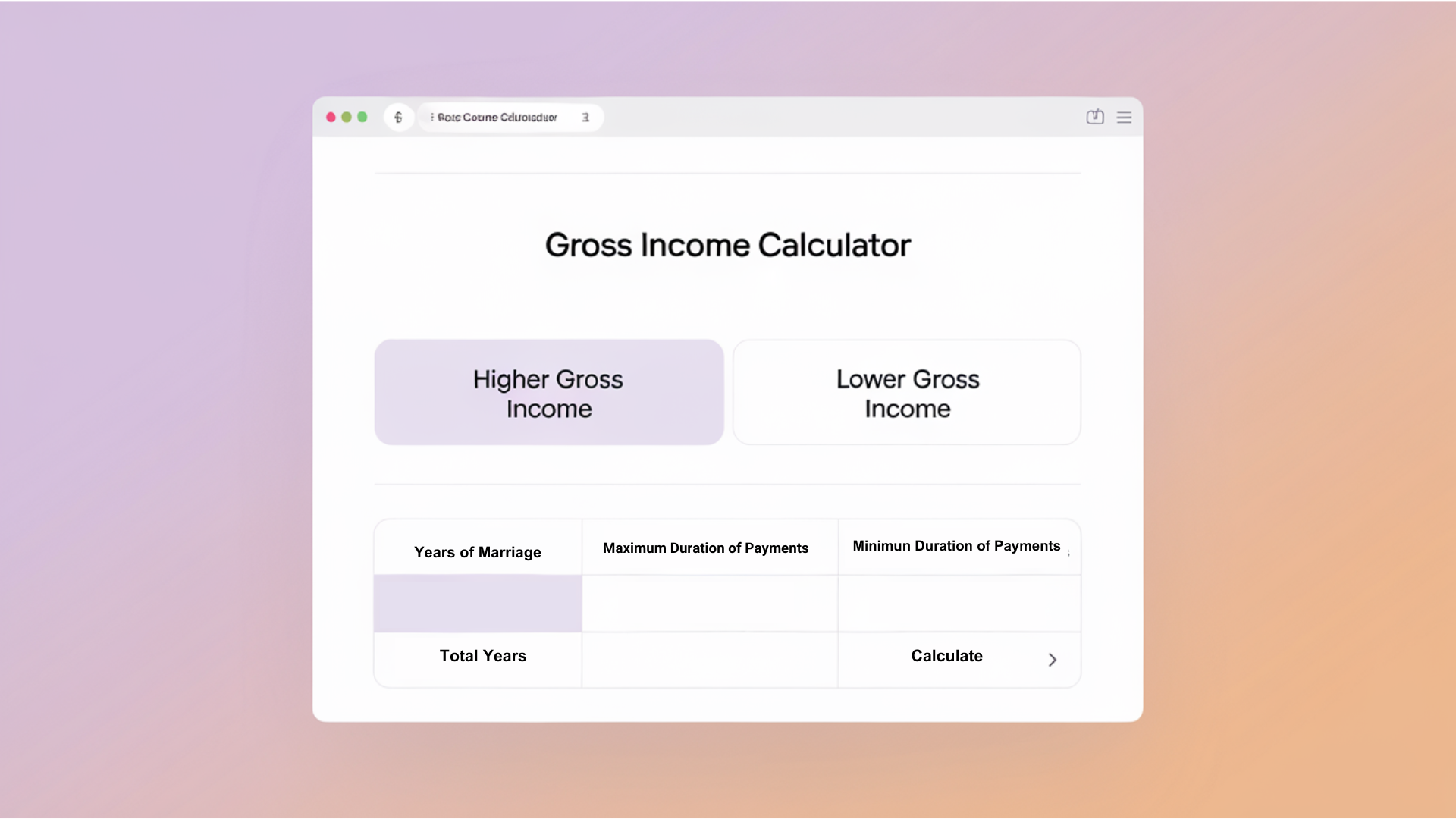

These calculators use specific inputs like income levels and marriage length to create reasonable support estimates, giving users valuable financial information before they enter legal discussions.

Purpose of Alimony Calculators

- Help determine fair alimony payments in Florida divorce cases.

- Analyze financial factors to generate estimated support obligations.

Key Factors Considered

- Higher gross income – The earning capacity of the higher-earning spouse.

- Lower gross income – The earnings of the lower-earning spouse.

- Duration of the marriage – Affects the length and amount of alimony.

- Minimum and maximum duration of payments – Provides insight into the expected payment period based on Florida law.

How the Calculator Helps

- Offers a clearer understanding of potential alimony responsibilities.

- Sets expectations before legal discussions or negotiations.

- Provides an informed starting point for determining support arrangements.

Benefits of Using an Alimony Calculator

- Helps individuals assess different financial scenarios.

- Aids in divorce preparation and financial planning.

- Supports mediation and court proceedings with realistic estimates.

- Leads to fairer outcomes for both parties by streamlining the negotiation process.

Steps to Calculate the Alimony Amount

This guide provides a clear, step-by-step approach to calculating alimony in Florida, ensuring a fair and accurate determination of financial support post-divorce.

Step 1- Calculate Total Income

Start by adding both spouses’ total income, including wages, salaries, bonuses, business earnings, and any other sources of income, such as investments or side businesses.

This comprehensive calculation ensures that all financial resources are considered and provides a clear picture of the couple’s financial situation.

Step 2 – Determine Deductible Expenses

Subtract essential living costs such as housing, food, healthcare, and utilities, along with taxes, to determine the net income available for alimony calculations.

This step helps to understand how much disposable income remains after covering necessary expenses, which is crucial for fair alimony determination.

Step 3 – Evaluate the Standard of Living

Examine the standard of living during the marriage to ensure that both spouses can maintain a similar quality of life after the divorce, taking into account daily expenses.

This evaluation helps to establish a fair baseline for alimony payments, ensuring that both parties can sustain their usual lifestyle.

Step 4 – Consider the Length of Marriage

The length of the marriage plays a key role in determining alimony. Generally, longer marriages lead to longer or higher alimony payments, as more time spent together can influence financial dependency.

This consideration helps to reflect the investment both partners made in the marriage and the level of financial support required.

Step 5 – Acknowledge Specific Circumstances

Take into consideration any special circumstances, such as one spouse having health issues or the other needing additional education or job training to become self-supporting.

These factors can significantly affect the financial needs and capabilities of each spouse, ensuring that the alimony arrangement is fair and just.

Step 6 – Review Each Spouse’s Ability to Support Themselves

The court will assess each spouse’s ability to become financially independent, especially if one spouse has been out of the workforce or is in need of further education.

This assessment helps to determine if and how much support is necessary for the less financially stable spouse to achieve independence.

Step 7 – Consider Tax Effects

Alimony payments can have tax consequences. The person paying alimony may be able to deduct the payments from their income, while the recipient might need to claim it as taxable income.

Understanding these implications ensures that both parties are aware of their tax responsibilities and can plan accordingly.

Step 8 – Evaluate Recipient’s Financial Needs

The calculator assesses the recipient’s needs to maintain a similar lifestyle after the divorce. This can include costs like housing, transportation, medical bills, and other living expenses.

Ensuring the recipient’s needs are met is crucial for fair support and maintaining their standard of living.

Step 9 – Consider Child Support Obligations

If children are involved, child support obligations will be factored in, as they can affect the amount of alimony one spouse may need to pay or receive.

Balancing child support and alimony ensures that both responsibilities are addressed, prioritizing the well-being of the children.

Step 10 – Final Adjustments by the Court

After using the alimony calculator for a rough estimate, the court may adjust the final amount based on the specific circumstances of the case and additional factors.

The court’s final decision aims to ensure fairness and address any unique aspects of the situation, considering all relevant details to make a just ruling.

Key Factors in Florida Alimony Calculations

- Length of Marriage: Marriage duration is critical to Florida’s calculations. Marriages under 7 years often receive different consideration than longer ones. Short-term marriages typically result in limited alimony duration, while marriages lasting many years could lead to extended support arrangements.

- Income Differences: The financial gap between spouses plays a central role in calculations. The calculator examines current earnings, potential future income, and any income changes that might occur after divorce. This helps ensure both parties maintain reasonable living standards.

- Health and Age: Physical condition and age significantly impact earning potential after divorce. These factors help determine if someone can maintain full-time employment or requires additional support. Medical conditions, disabilities, or age-related limitations are carefully considered in the calculations.

- Education Level: Academic and professional qualifications shape future job prospects significantly. The calculator examines if additional training or education might help someone achieve financial independence.

- Standard of Living: The lifestyle maintained during marriage sets a baseline for post-divorce arrangements. The calculator considers housing costs, regular expenses, and typical spending patterns during the marriage.

- Child Care Responsibilities: Parenting duties can significantly affect work opportunities and earning potential. It considers school schedules, special needs care, and other parenting obligations influencing income potential.

- Financial Resources: Available assets, investment accounts, and various income streams shape the final calculations. This includes examining retirement funds, property values, inheritance prospects, and other financial resources.

Types of Alimony in Florida

Florida courts offer different types of alimony to address varying financial needs after divorce.

Each type serves a unique purpose, ranging from temporary assistance to long-term financial support.

1. Bridge-the-Gap

This type helps the receiving spouse move from being married to being single. It covers immediate needs right after divorce, like moving costs or getting set up in a new home.

The payments only last up to two years and can’t be changed once set. It works well for people who just need a little help getting started on their own.

This support also helps cover the gap between shared expenses during marriage and new single-life costs.

2. Temporary Alimony

These payments help during the divorce process itself. They make sure both people can pay their bills while the divorce is happening.

The amount depends on immediate needs and usually stops when the divorce is final. It helps maintain stability during a challenging time.

The court looks at current income and expenses to set a fair amount. This type can be adjusted if circumstances change significantly during the divorce process.

This support ensures neither party faces financial hardship while legal matters get resolved.

3. Rehabilitative Alimony

This helps someone become self-supporting through education or training. The payments cover costs like going back to school or learning new job skills.

A clear plan must show how the money will lead to financial independence. The court reviews progress to ensure the plan stays on track.

This support type often includes money for books, supplies, and certification costs. It might also cover living expenses during the training period.

The goal is to help someone gain the skills needed for long-term financial stability.

4. Durational Alimony

Set for a specific time period, this type provides regular payments after divorce. The length can’t be longer than the marriage lasted.

It helps maintain living standards for a set time while someone adjusts to a single life.

The payments give people time to build their own financial foundation. Courts often use this type for marriages lasting between 7 and 17 years.

The amount considers both current needs and the time needed to become self-sufficient. This support provides a clear timeline for both parties to plan their futures.

5. Permanent Alimony

For marriages over 17 years, these payments are given indefinitely to maintain living standards when one spouse can’t support themselves.

Health problems or age might make earning enough income hard. The court looks at factors like job skills and job market conditions.

These payments acknowledge the long-term financial impact of marriage roles and provide financial security for spouses focused on family rather than career.

The amount can be adjusted if there are significant changes in circumstances.

6. Lump Sum Alimony

Instead of monthly payments, this provides one big payment or a few large payments.

It can help avoid future disputes and give the receiving spouse immediate financial security. This type works well when there’s property to divide.

It offers a clean break and reduces ongoing financial ties between former spouses. The receiving spouse gains control over how to use or invest the money.

This option helps people who prefer managing their own finances in the long term. The amount factors in future needs and inflation.

7. Combined Alimony

This combines different alimony types to meet specific needs. For example, someone might receive both bridge-the-gap and rehabilitative support.

It creates a flexible plan that changes as needs change over time. The court can adjust parts of the support separately as needed.

This approach suits complex situations with varying needs, offering both short-term stability and long-term planning. The combination helps address both immediate and future financial challenges.

Maximum Alimony Payment Duration

Florida law establishes clear time limits for alimony payments based on marriage length. Alimony payments typically run for shorter periods for marriages lasting less than 7 years.

Medium-length marriages between 7 and 17 years allow for moderate support durations. Marriages extending beyond 17 years might qualify for longer-term support arrangements.

These timeframes create structure while allowing flexibility for unique situations.

Courts can adjust these periods based on specific circumstances, such as health issues or significant income disparities.

The guidelines aim to provide fair support while encouraging financial independence when possible.

This system helps both parties understand potential payment durations and plan accordingly for their financial futures.

Conclusion

Florida alimony calculators serve as helpful tools in making sense of support payments during divorce.

While they can’t predict the exact amount a court will order, these calculators offer valuable insights into what to expect.

Remember that each case is unique, and the final decision rests with the court. The calculators provide a starting point for discussions between both parties and their legal teams.

They consider key elements like marriage length, income differences, and living standards to suggest reasonable support amounts.

These calculators, by providing clear estimates, can make the process less stressful for anyone going through a divorce in Florida.

Want to learn more about your specific situation? Consider talking with a family law professional who can guide you through the details.

Frequently Asked Questions

What is the New Alimony Law in Florida?

Florida’s 2023 alimony law removed permanent alimony. Support payments are now linked to marriage length, with clear end dates and modified payment calculations.

What Disqualifies You from Alimony in Florida?

Adultery, remarriage, living with a new partner, or reaching financial independence can end alimony rights in Florida. Poor behavior during marriage may also affect eligibility.

How to Avoid Alimony in Florida?

Get a prenuptial agreement, keep detailed financial records, maintain separate accounts, or reach a mutual settlement. Short marriages under 7 years rarely require long-term alimony.